ASSETs for Life

Main Navigation

Emission-Free Cities

Emission-free cities are attainable through the integration of continuous efficiency improvements in all energy, water and resource using devices, along with solar and wind power. Modest amounts of other renewables (water, geothermal, biowastes) will provide remaining sums to attain 100% emission-free energy system. Here are some details.

EFFICIENCY

The past half-century has been witness to an explosion of knowledge generation, scientific breakthrough, technical advances, engineering progress, and accumulated evidence from applied innovations in markets and governance that offer promising prospects for addressing the seemingly intractable perils confronting humanity and the planet.

Empirical evidence accumulated over the past four decades clearly and unequivocally point to improving the efficiency in the way utility (electricity, natural gas, water), mobility and industrial services are delivered to the point of use as the largest pool of least-cost-and-risk opportunities for achieving immediate, ongoing, and deep reductions in global CO2 emissions.

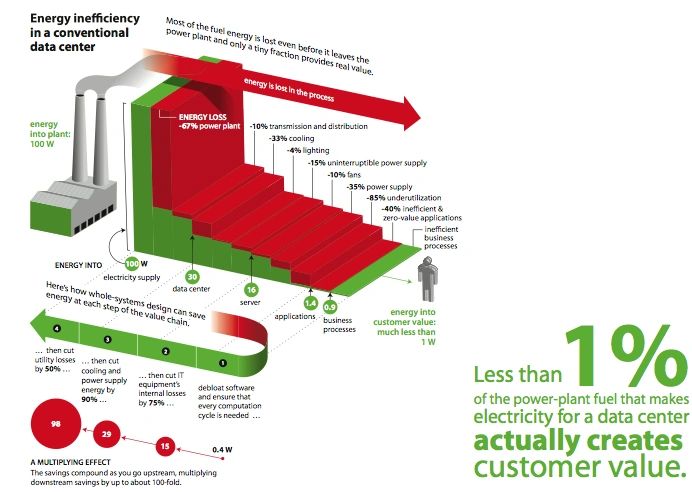

This amounts to a paradigm shift from the industrial smokestack era of economic growth which achieved economy-of-scales constructing larger factories powered by bigger centralized power plants. The scientific revolution in solid-state electronics and space-age materials have led to new economy-of-scales through the delivery of distributed services at the point of use. Services are delivered while dramatically reducing the amount of upstream natural resources and downstream wastes and pollution, as well as lifecycle costs, as extensively detailed regarding utility services in, Small is Profitable: the Hidden Economic Benefits of Making Electrical Resources the Right Size.

Without faster, smarter, more efficient ways of delivering energy services, energy consumption in the US would have risen 225 percent from 1973 to 2005. Instead, energy consumption in 2005 increased only 30 percent. The difference (75 exajoules, EJ) also avoided $700 billion per year in higher energy bills.

How much is 75 EJ? Envision a freight train annually hauling nearly 18,000,000 railcars of coal, which would wrap around the world seven times. As world energy expert Amory Lovins calculated, the nearly 40% drop in energy required per unit of GDP from 1975 to 2000 represented, by 2000, "an effective energy 'source' 1.7 times as big as US oil consumption, [and] five times domestic oil output."

The U.S. has displaced the equivalent of 25 million barrels of oil per day. Yet, the U.S. still remains so inefficient, and the pool of energy efficiency opportunities continues to greatly expand, that massive savings remain to be tapped. In the recent assessment, Reinventing Fire: Bold Business Solutions for the New Energy Era, Lovins and his colleagues detail another 25 million barrels of oil per day equivalent savings the U.S. can achieve at an average cost below $20 per barrel. By comparison, the average price of world crude oil since 2006 has ranged between $60 and $120 per barrel.

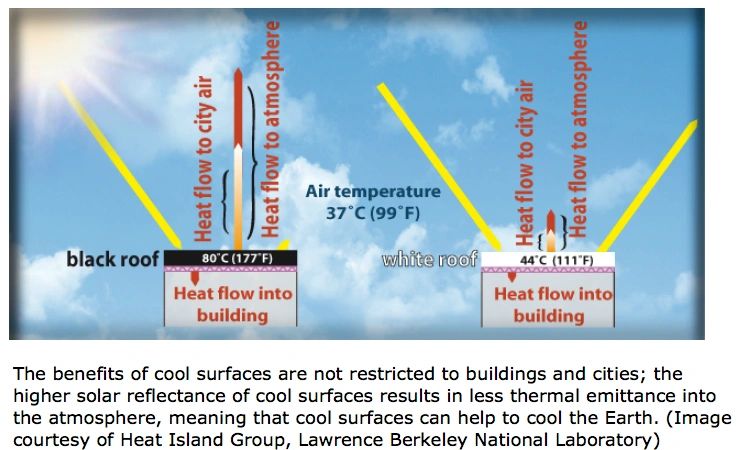

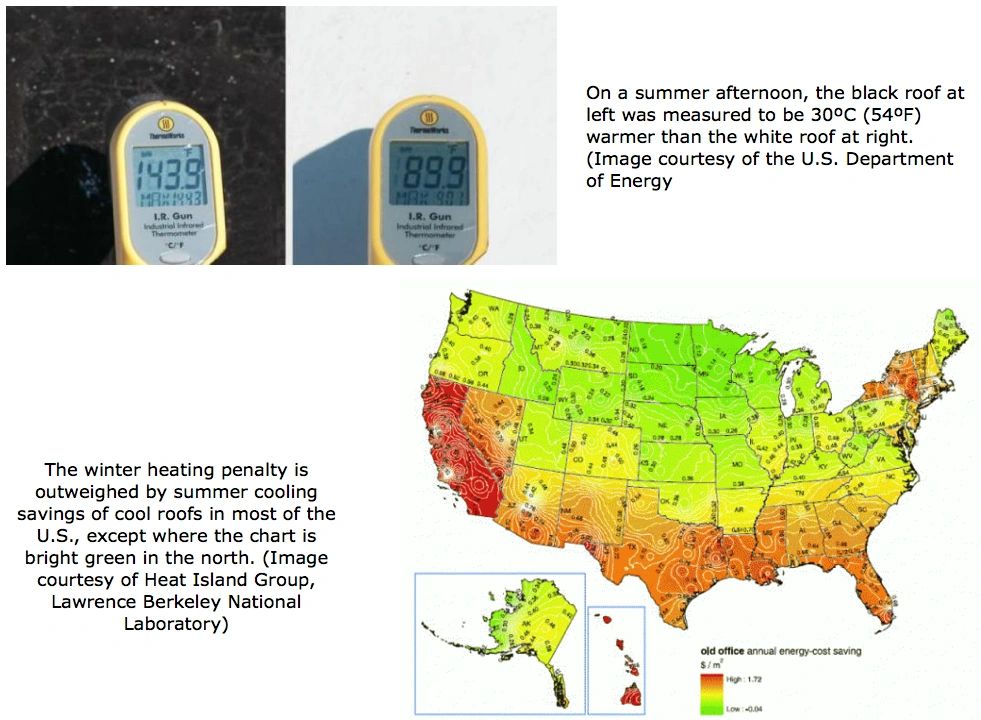

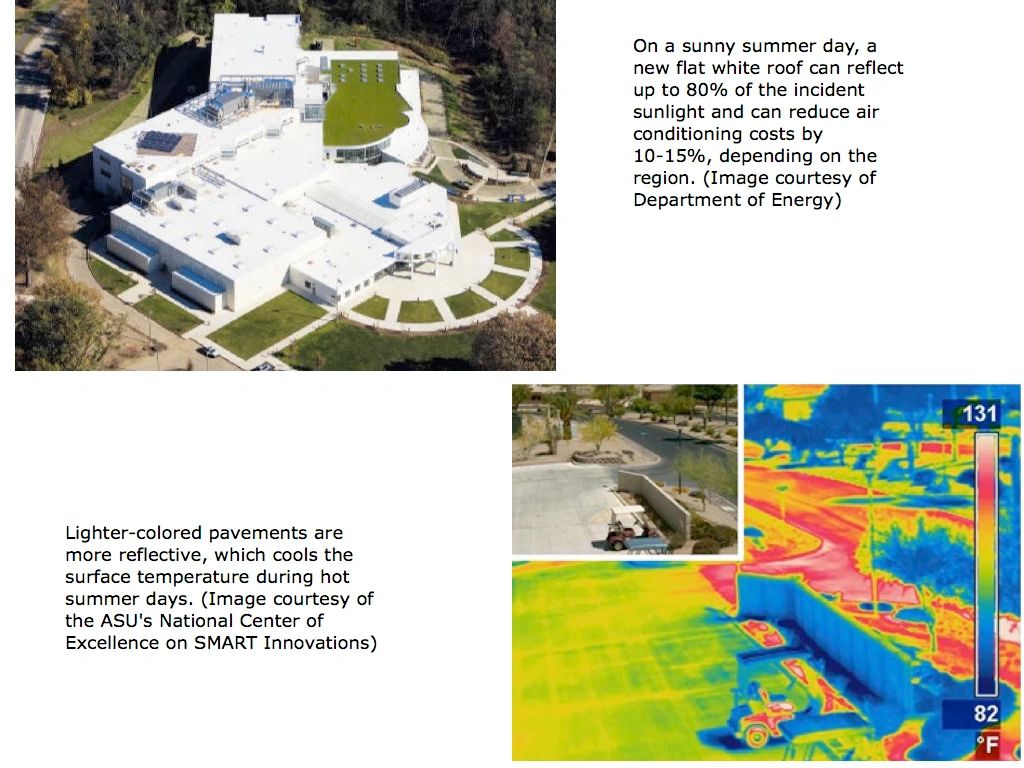

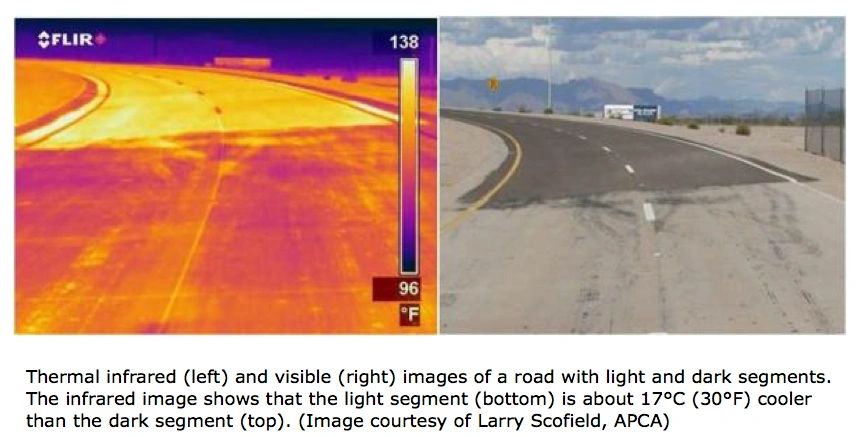

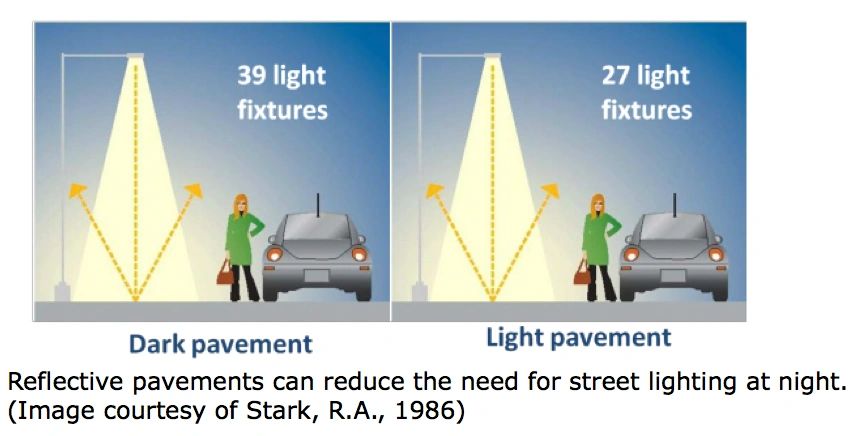

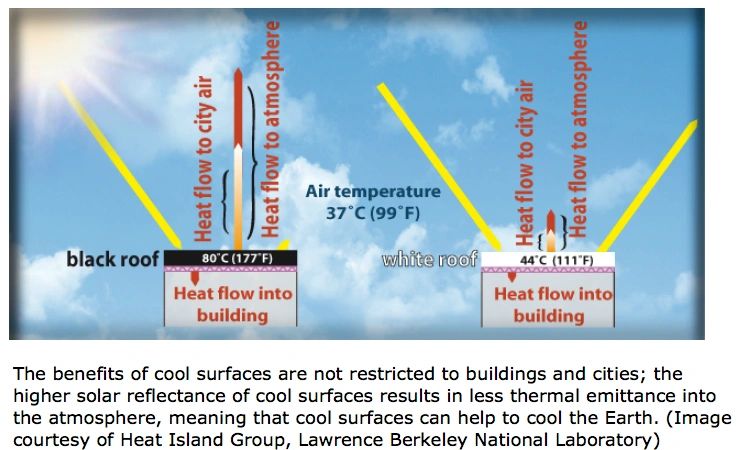

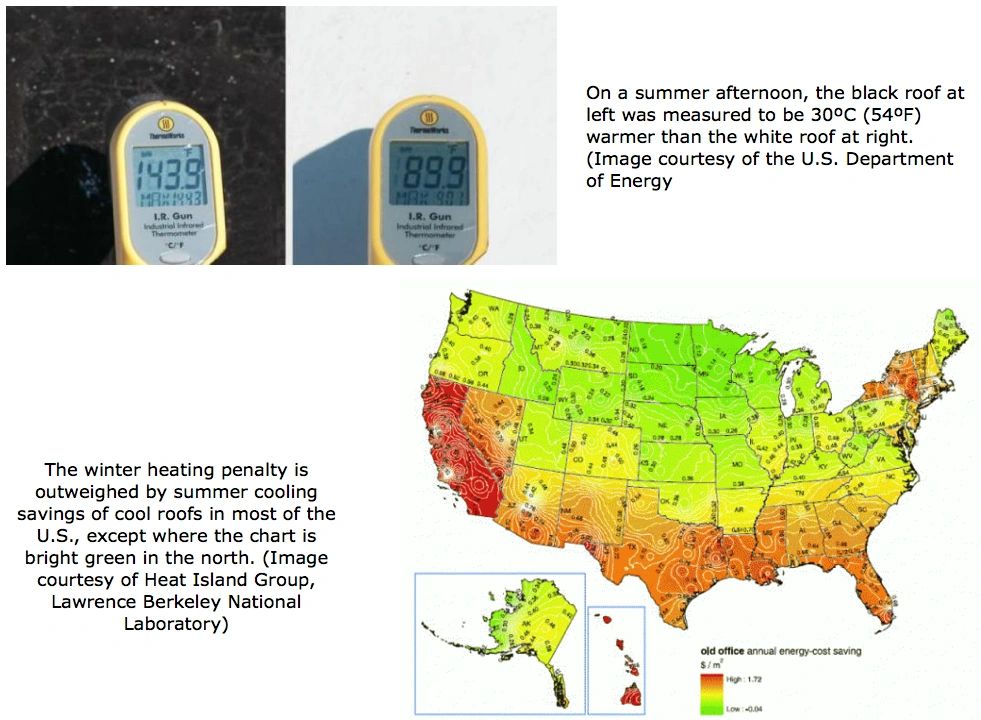

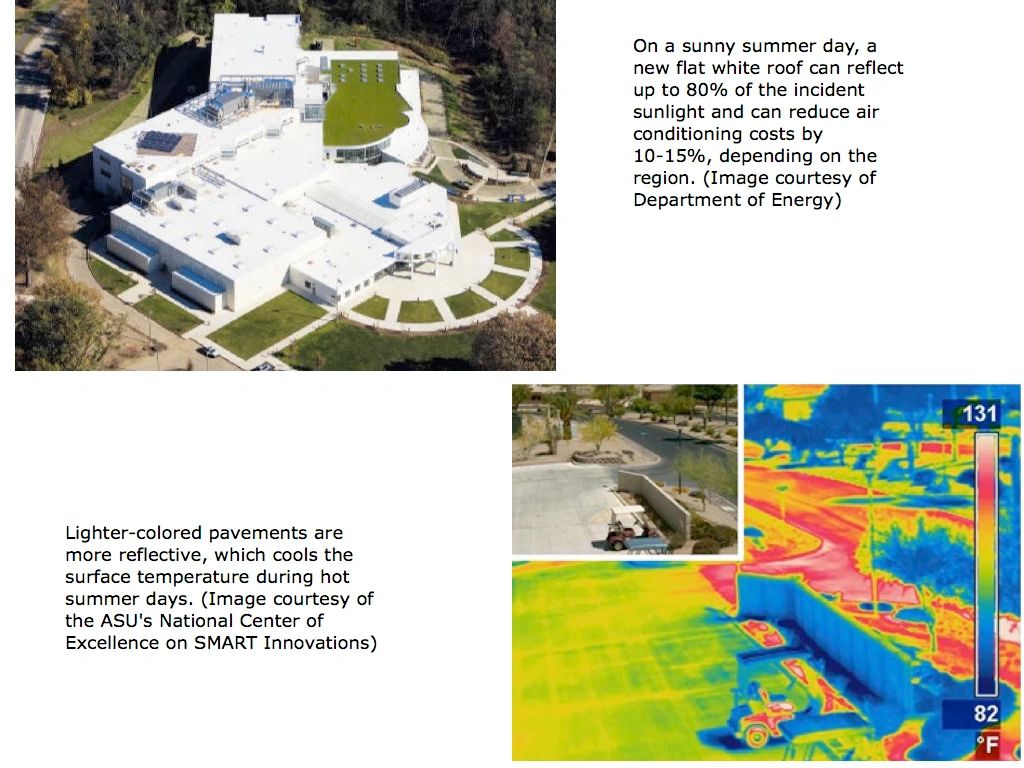

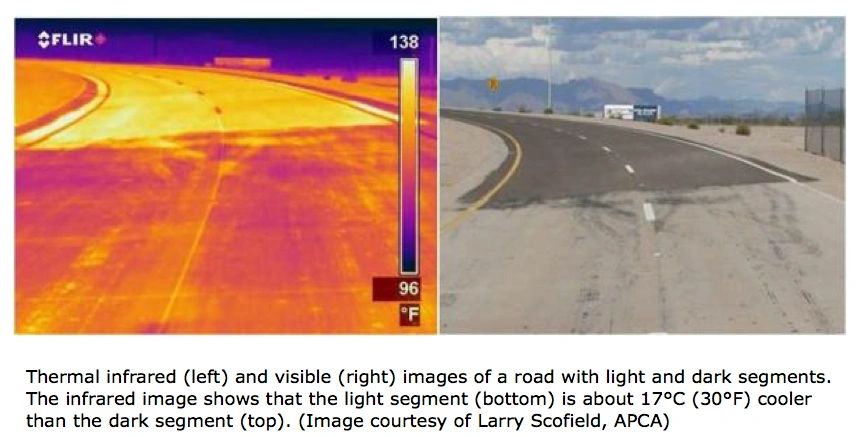

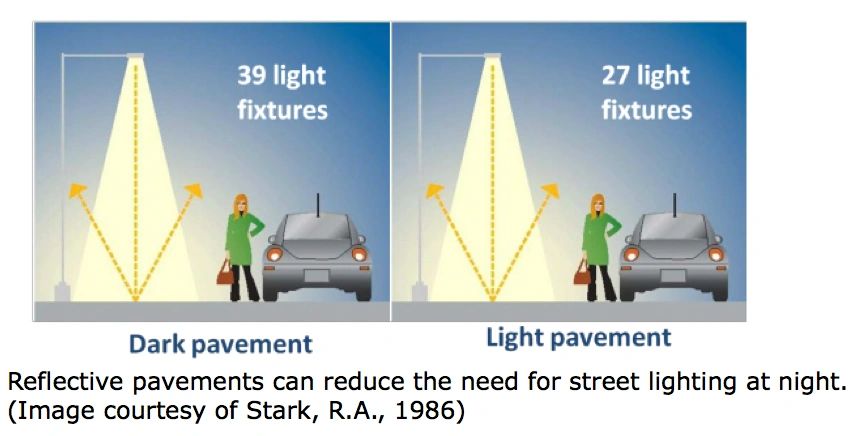

A stellar example is how to cool down urban heat islands. A staggering sum of between 25 and 150 billion tons of CO2 emissions could be prevented through this urban retrofit process, while accruing multi-trillion dollar savings through avoided power plants and air condition equipment. It involves painting flat roofs white, and replacing low-albedo roof shingles with high-reflecting ones, so the sun’s heat is not absorbed. It also involves resurfacing black asphalt pavements with white cementitious finishes which also reflect away the sun’s heat. The rooftop efficiency measure is so cost-effective it has now been integrated into California’s world-leading Title 24 building standards. Lawrence Berkeley National Laboratory's Heat Island Group, pioneered by University of California at Berkeley Professor Arthur Rosenfeld, Dr. Hashem Akbari and their colleagues, has generated a wealth of knowledge on cooling down heat islands. The following images all come from LBNL's Heat Island Group web site

LIFECYCLE LEAST-COST-AND-RISK (LCR) DELIVERED UTILITY SERVICES

Among a dozen states leading the USA in efficiency gains, California has been the exemplary model. Since the 1980s, California has been a world leader in developing a utility regulatory process that aligns the financial interests of the utility with those of their customers to capture end-use efficiency opportunities. This holds true for private-owned and public-operated utilities. California achieved this alignment by decoupling utility earnings from revenues to eliminate the perverse incentive of expanding supplies that are five times more costly than end-use efficiency gains.

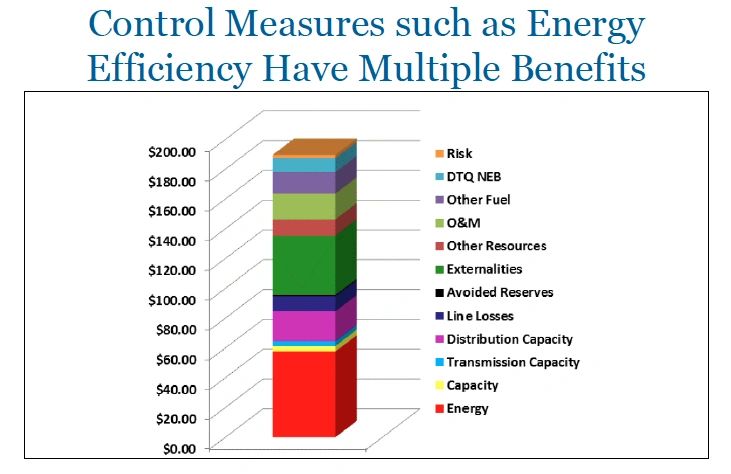

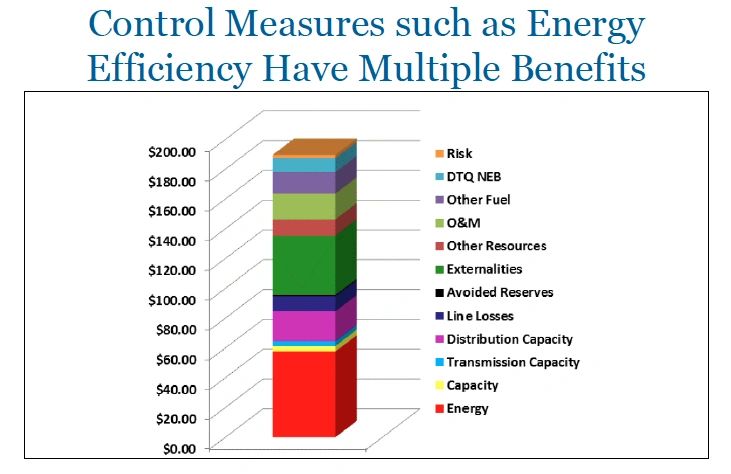

This was combined with a comprehensive Integrated Resource Planning (IRP) methodology that calculated the levelized lifecycle cost-and-risk of delivering utility services from all supply and all end-use efficiency options. All options are priority ranked in order of least-cost-and-risk (LCR). End-use efficiency options have consistently and persistently ranked as the LCR. Ongoing assessments by McKinsey Global indicate LCR end-use options could provide half to three-fourths of all new utility services worldwide, based on utilities’10 to 12 percent fixed earnings on capital.

California’s highly innovative regulatory framework is so effective because it is based on allowing utility companies to recoup lost earnings from reduced sales in return for assisting customers to reduce their utility bills through capture of cost-effective end-use and locally distributed efficiency gains in buildings, factories, appliances and devices. The result is delivery of more services with less energy or water resources.

The powerful paradigm shift refocuses the utility's attention and motivation, because their earnings remain robust even when revenues decline, while customers enjoy lower utility bills through smarter use even though the underlying rate increases (to recoup the utility’s lost earnings). Most importantly, the utility’s capital investment, previously limited to large power plants operating over 30 to 50 year time horizons, is diversified by focusing on a larger pool of lower cost end-use efficiency services.

When combined with California's world leadership in setting continuously stronger appliance and building efficiency standards, these efforts have allowed the state to save customers an average of $165 per capita per year on electric and water utility bills, and the utility sector has CO2 emissions 50 percent below the national average. If all U.S. states had followed California's end-use efficiency model, the U.S. national energy bill would be several hundred billion dollars less per year. The country also would have surpassed the CO2 reduction targets of the Kyoto Protocol at essentially zero cost to ratepayers and taxpayers.

One among many 30% solutions: High-Performance Electric Motor Drive Systems

A clear example of how important comprehensive IRP utility regulatory reform is needed to capture end-use efficiency services involves the persistence and ubiquity of obsolete and inefficient electric motor drive systems around the world. Half of the world’s electricity is consumed by industrial electric drive systems — electric motors, pumps, compressors and fans (60 percent in China).

Fifty percent savings are achievable in new motor systems if high-efficiency electric motor industrial drive system components are implemented by users. However, the conventional practice is to procure technologies that require the lowest capital cost, while ignoring how inefficient they perform in terms of energy consumption, lifecycle costs and emissions. In some instances, these inefficient devices will consume up to 20 times more in electricity costs when compared to the motor’s purchase price.

IRP-based utility efficiency incentive programs have been instrumental for decades in overcoming this distortion; utility financed efficiency upgrades to existing systems can achieve 30 percent savings at five to ten times less cost per kWh when compared to building new generation facilities to power the inefficient devices that dominate the current market.

Worldwide, an initiative for transforming the efficiency of electric motor systems would deliver the services equivalent to 2 trillion kWh per year, equal in services to one-fourth of all power plants planned for construction through 2030. A successful market transformation would reduce global energy bills by ~$1.6 trillion per decade.

The ancillary benefits for a world confronting droughts and water shortages would be significant, as the following illustrates. If motor efficiency gains were used to displace thermal power plants, the savings in water use would range between two and 200 billion m3 per year -- equivalent to the water use of one to 10 Colorado Rivers.

SOURCE: (Left) Amory Lovins, Reinventing Fire, 2012, Rocky Mountain Institute; (right) Chris James, Co-Control of Air Pollutants, Integrated Planning for Environment and Energy BAQ 2012 – Hong Kong, December 2012, Regulatory Assistance Project.

China End-Use Efficiency Example

In China, the potential energy savings from efficiency gains from electric motor drive systems are worth several hundred billion dollars per decade, displacing the need for 63,000 MW of planned power plants. Jiangsu province is leading the effort, identifying 10,000 MW of motor efficiency gains that can be delivered at a cost of US$0.01 per kWh. By comparison, the Jiangsu electricity price delivered to the industrial sector in 2012 was US$0.14 per kWh (0.87 Yuan).

Hypothetically, applied comprehensively to all power-consuming uses throughout China’s residential, commercial, institutional, industrial and agricultural sectors, end-use efficiency and decoupling methodologies could help in avoiding half of an estimated US$10 trillion in utility expenditures incurred from the power plants to be built by 2030.

China has been a world leader in pursuing ambitious energy efficiency targets. From 1980 to 2002, China experienced a 5% average annual reduction in energy consumption per unit of gross domestic product (GDP). There was a dramatic reversal of this historic relationship between 2002 and 2005, when efficiency options were largely ignored and energy intensity increased 5% per year. However, China‘s 11th Five Year Plan (FYP) set a target of reducing energy intensity by 20% by 2010, followed by the 12th FYP target for a 16 percent reduction in energy intensity between 2011 and 2015.

According to a recent assessment by LBNL, selected policies and programs that China has instituted to fulfill the national goal have made substantial progress. Many of the energy-efficiency programs appear to be on track to meet – or in some cases exceed – their energy-saving targets. Most of the Ten Key Projects, the Top-1000 Program (1000 largest companies, consuming about one-third of the China’s energy), and the Small Plant Closure Program (a total of 80,000 MW of inefficient thermal plants and industries were shut down) met or surpassed the 11th FYP savings goals. In the 12th FYP China extended the Top-1000 program to the Top-10,000 program.

Zeroing In on Zero-Emission Supply Options

Wind Power

In less than a decade, China has rapidly become the world’s biggest manufacturer of wind turbines and solar PV panels. The country established a feed-in tariff for wind in 2009 and for solar PV in 2011.

China is developing different FIT rates depending on local resource conditions. The National Development and Reform Commission (NDRC) set four categories of onshore wind projects. Areas with better wind resources get lower feed-in tariffs, while those with lower outputs will be able to access higher tariffs. The wind power tariffs per kWh are set between US$0.082 (0.51 Yuan) and US$0.098 (0.61 Yuan). For comparison, the average rate paid to coal-fired electricity generators is US$0.055 per kWh (0.34 Yuan).

In recent years, China’s ambitious renewable power targets and support for wind energy manufacturers have fueled rapid growth. In 2006, China had only 3,000 MW of installed capacity, and a tiny global player. By late 2012 China surpassed 70,000 MW, reaching nearly one-third of installed global capacity – a 25-fold increase, in six years while the rest of the world only expanded by a factor of 2.6.

China is projected to shatter the government’s 2015 target of 100,000 MW by 50 percent. China has been consistently exceeding its wind growth targets, so it is quite feasible their ambitious targets for 2020 (200,000 MW), 2030 (400,000 MW) and 2050 (1 million MW) will all occur much sooner. China now leads the world both in production and use of wind power.

The USA, with 60,000 MW of installed wind capacity and ranked second with 25% of global total, may not renew the tax incentive for wind power after 2013. A tragic mistake if Congress takes this step. The USA, like China, has immense wind resources, far larger and more economical than even their massive reserves of coal and oil shale.

A 2009 joint assessment by Harvard’s School of Engineering and Applied Science and Tsinghua University’s Department of Environmental Science and Engineering concluded that China’s favorable onshore wind resources could provide nearly 25 trillion kWh of electricity annually, more than five times national consumption in 2012. The team also made a key point, “[A]ssuming a guaranteed price of 0.516 Yuan (7.6 U.S. cents) per kWh for delivery of electricity to the grid over an agreed initial average period of 10 years, wind could accommodate all the demand for electricity projected for 2030, about twice current consumption.”

The Harvard team also analyzed the wind potential worldwide, as well as in the contiguous USA. Writing in the Proceedings of the National Academy of Sciences, they conclude, “that a network of land-based 2.5 MW turbines restricted to non-forested, ice-free, non-urban areas operating at as little as 20% of their rated capacity could supply more than 40 times current worldwide consumption of electricity, [and] more than 5 times total global use of energy in all forms.”

Available wind resources on the U.S. Great Plains were estimated to be as much as 16 times total current U.S. power consumption. The land footprint of wind farms are remarkably small. Analysis indicate the several million wind turbines that could produce as much power as the U.S. currently consumes would take up less than three percent of the Great Plains region. The wind royalties paid to site the wind farms would generate twice as much revenues for the region than farming and ranching currently generate occupying 75 percent of the Great Plains!

Wind power is an established least-cost-and-risk power supply. Both the United States and China could steadily displace all their current and proposed coal power plants, and most natural gas power, with their wind resources. China has current plans to construct 558,000 MW of coal plants (the US 17,000 MW), and the US projects building 141,000 MW of natural gas plants.

When wind (and solar) are phased in with utility bill-reducing efficiency opportunities, the system costs and risks of delivering electricity should be comparable to or less than continuing dependence on coal or natural gas plants powering inefficient devices. This transformational action would also position the two wind-giant nations to seize a substantial share of the multi-trillion dollar wind export market opportunity worldwide.

Solar Power

Beginning in 2011, China established a national feed-in tariff for solar projects, setting the FIT at US$0.15 per kWh. At the end of 2012, China had 5,000 MW of installed solar PV capacity; it also set a new high bar for other nations in committing to solar power. The government declared an eight-fold increase in its solar power target for 2015 to 40,000 MW. This will put China far ahead of any other nation. For comparison, the U.S. had 6,400 MW installed at the end of 2012, with solar tax incentives set to expire in 2015. As in the case of expiring U.S. wind production tax credits, (PTC) this is entirely in the wrong direction to be moving. Why?

First, because it undermines any semblance of a level playing field. Fossil fuels, as well as nuclear power, have received 20 times more government subsidies over the past half century than have solar and wind. Moreover, the tax incentives for solar and wind power represent a minute fraction of the massive costs due to fossil fuel externalities.

Second, unlike fossil fuel power plants (and nuclear and large-hydro), which use 40 percent of U.S. extracted water, solar PV and wind power require 95 percent less water. In a water-constrained world that is only worsening, the water frugality of solar PV and wind power make them low-risk assets over a lifetime of price volatility. They are also inherently low-risk assets in providing protection against any future price volatility as a result of being power generators with zero fuel requirements and zero emissions, pollution and wastes.

Third, given the imperative to expedite a global economy powered with zero emissions, the export market growth potential of solar and wind technology is immense. This is illustrated in the recent global renewable energy scenario by Stanford Professor Mark Jacobson and University of California Professor Mark Delucchi, A Plan for a Sustainable Future by 2030.

Beginning with the implementation of the robust energy efficiency improvements noted above -- a gargantuan export market potential, in itself, in every energy-consuming end-use appliance, device, and equipment category -- the authors show that solar and wind power could provide 90 percent of global total power and energy demand phased in over several decades. Geothermal and hydro power provide most of the other10 percent, while also providing an important storage function to complement the intermittent solar and wind power.

One can debate the achievable annual growth rates, which appear to average 25 percent per year for wind and 40 percent for solar PV. There is historical precedence for such high growth rates. Between 1956 and 1980, before nuclear power fell out of favor, global installed nuclear generating capacity grew at an average rate of 40% per year. Like nuclear power in its heyday, wind and solar will need strong, sustained supporting public policies to maintain such high growth rates.

Powering Mobility

A key component of the Jacobson-Delucchi assessment is the shift to ultra-lightweight battery-electric vehicles (BEV) for displacing petroleum-fueled combustion engines, and entirely avoiding biomass-fueled vehicles. Converting crops to fuels is very inefficient, while requiring enormous land area and water consumption. For example, just shifting from diesel to biodiesel to fuel the world’s maritime fleet would require a 40-fold expansion of current global production of oil palm plantations. Oil palm plantations have been one of the primary causes of widespread deforestation (and CO2 emissions) of biodiversity-rich rainforest in recent decades.

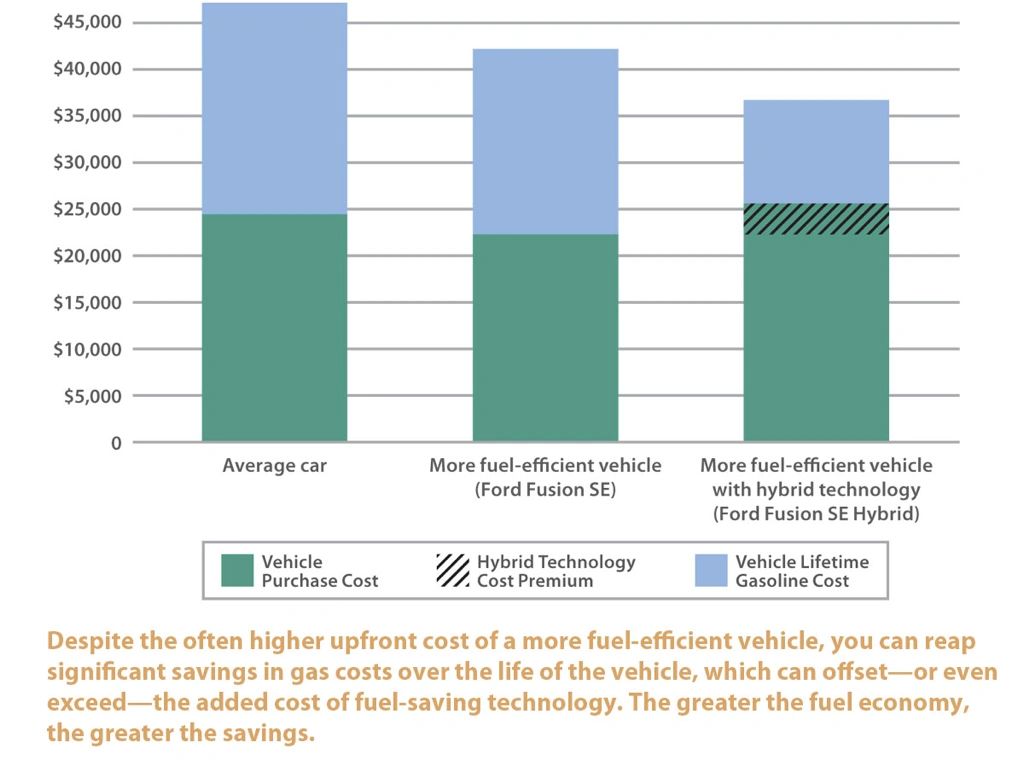

As car manufacturers replace heavy steel components with crash-impact resistant ultra-light carbon composites, a vehicle’s reduced mass significantly reduces the amount of batteries required. Most of the running cost of a BEV is for the maintenance of the battery pack, and its eventual replacement. A BEV incurs low maintenance costs because it has only around five moving parts in its motor, compared to hundreds of parts in a gas-fueled internal combustion engine.

Electric drive systems are four to five times more efficient (80%) than diesel (20%) or gasoline engines (15%), respectively. According to the U.S. Environmental Protection Agency (EPA) fuel economy ratings for city driving, the 11 BEV models sold in 2012 averaged between 33 and 59 kilometers per liter-equivalent, km/l-e (77 to 138 mpg-e). By comparison, the EPA fuel economy rating for the average new (fuel combustion) car in 2012 was 9.4 km/l (22 mpg).

EPA estimated the total CO2 emissions from a new gasoline car at 311 grams per kilometer (500 g/mile), which includes upstream gas production and tailpipe emissions. The grams of CO2 per km for a BEV varies greatly, since it depends on how clean or dirty is the power grid. The Jacobson-Delucchi clean grid scenario would result in BEV CO2 emissions near 10 g/km, whereas an all-coal grid would exceed 250 g/km.

Both China and the USA officials have raised security concerns that more than 50% of their oil use is dependent on vulnerable foreign oil imports, and China’s oil imports are projected to double by 2020. This is the major impetus for both nations in promoting domestic oil shale reserves and biofuels, despite substantially increasing CO2 emissions.

China is the world’s largest car producer, manufacturing 1 of every 4 cars, and the car markets in China and the US jointly account for more than one-third of world sales. McKinsey Consulting noted in their recent report, Recharging China’s electric vehicle aspirations, that if China were to achieve US levels of per-capita vehicle penetration, its demand for oil would increase 15-fold, exceeding total global production. BEVs are critical to China’s economic, security, and environmental sustainable growth.

In his 2011 State of the Union speech, President Obama, announced a goal of having 1 million BEVs on the road by 2015. This coincided with China’s 12th FYP targets for ownership of 5 million BEVs and PHEVs (plug-in hybrid electric vehicles) by 2020. Both governments have made multi-billion dollar commitments in developing advanced batteries, and providing consumers with incentives to purchase EVs. However, as the McKinsey EV report details, both nations are in need of substantially refined policies and incentives to ensure a steady acceleration and scaling of BEV production and sales.

BEV bicycles and scooters are an entirely different, and highly successful story. China has experienced an explosive growth of sales of BEV bicycles, scooters and motorcycles, with annual sales jumping from 56,000 units in 1998 to over 21 million in 2008. China is home to 150 million e-bikes as of 2012, with sales increasing 10% per annum. China is the global leader both in the production (22 million per year) and consumer use of e-bikes. Sales of more than 466 million e-bikes and scooters are projected by 2016, with China continuing to dominate the world market with more than 95% of sales.

Furthermore, with gas prices exceeding US$0.80 per liter ($3 per gallon) -- equivalent to electricity at $0.32 per kWh -- solar electric charging stations are cost-effective to power the world’s e-bikes.

The combination of solar and wind powering ultra-lightweight BEVs accrue multiple economic and environmental benefits: dramatic gains in urban and rural air quality and tremendous health gains for the severely afflicted citizens experiencing record-breaking air contamination, elimination of vulnerable and volatile-priced foreign oil imports, financial savings from avoided gasoline purchases, elimination of vehicle emissions, and deep reductions in CO2 emissions.

FEED-IN TARIFFS - FIT POLICY FOR DRIVING ZERO EMISSION OPTIONS

Feed-In Tariffs (FIT) are proving essential for spurring zero and near-zero emission power options -- solar, wind, geothermal, biowastes, small-scale hydro. Depending on how effective a FIT is designed and implemented can lead to order of magnitude differences in the amount of clean power harnessed. Given the urgency this decade in reducing CO2 emissions, adoption of highly effective FITs become an imperative for aligning good governance and flourishing markets. As of 2011, feed-in tariff policies have been enacted in China, 7 U.S. states, and in more than 50 countries.

Utility investments in regulated states typically receive a guaranteed 10 to12 percent return on investment. FITs are often set to provide an 8 to 10 percent internal rate of return (IRR). A FIT guarantees a long-term purchase contract for electricity to help investors recover their investment. Solar, wind, and end-use efficiency projects have no fuel, water or waste storage and disposal costs, so their entire investment is up front. Long term contracts, generally 20 years, ensure that energy providers recover their costs and help them secure financing.

The benefits of a well-designed and implemented FIT outweigh the costs of the premium paid to renewables even without taking into account the economic development impacts. The German ministry overseeing their feed-in tariff estimates that the total benefits of the legislation have exceeded the costs by a factor of three.

Check back for further developments. michael p totten, founder & principal, AssetsforLife.net. LinkedIn background info.

EFFICIENCY

The past half-century has been witness to an explosion of knowledge generation, scientific breakthrough, technical advances, engineering progress, and accumulated evidence from applied innovations in markets and governance that offer promising prospects for addressing the seemingly intractable perils confronting humanity and the planet.

Empirical evidence accumulated over the past four decades clearly and unequivocally point to improving the efficiency in the way utility (electricity, natural gas, water), mobility and industrial services are delivered to the point of use as the largest pool of least-cost-and-risk opportunities for achieving immediate, ongoing, and deep reductions in global CO2 emissions.

This amounts to a paradigm shift from the industrial smokestack era of economic growth which achieved economy-of-scales constructing larger factories powered by bigger centralized power plants. The scientific revolution in solid-state electronics and space-age materials have led to new economy-of-scales through the delivery of distributed services at the point of use. Services are delivered while dramatically reducing the amount of upstream natural resources and downstream wastes and pollution, as well as lifecycle costs, as extensively detailed regarding utility services in, Small is Profitable: the Hidden Economic Benefits of Making Electrical Resources the Right Size.

Without faster, smarter, more efficient ways of delivering energy services, energy consumption in the US would have risen 225 percent from 1973 to 2005. Instead, energy consumption in 2005 increased only 30 percent. The difference (75 exajoules, EJ) also avoided $700 billion per year in higher energy bills.

How much is 75 EJ? Envision a freight train annually hauling nearly 18,000,000 railcars of coal, which would wrap around the world seven times. As world energy expert Amory Lovins calculated, the nearly 40% drop in energy required per unit of GDP from 1975 to 2000 represented, by 2000, "an effective energy 'source' 1.7 times as big as US oil consumption, [and] five times domestic oil output."

The U.S. has displaced the equivalent of 25 million barrels of oil per day. Yet, the U.S. still remains so inefficient, and the pool of energy efficiency opportunities continues to greatly expand, that massive savings remain to be tapped. In the recent assessment, Reinventing Fire: Bold Business Solutions for the New Energy Era, Lovins and his colleagues detail another 25 million barrels of oil per day equivalent savings the U.S. can achieve at an average cost below $20 per barrel. By comparison, the average price of world crude oil since 2006 has ranged between $60 and $120 per barrel.

A stellar example is how to cool down urban heat islands. A staggering sum of between 25 and 150 billion tons of CO2 emissions could be prevented through this urban retrofit process, while accruing multi-trillion dollar savings through avoided power plants and air condition equipment. It involves painting flat roofs white, and replacing low-albedo roof shingles with high-reflecting ones, so the sun’s heat is not absorbed. It also involves resurfacing black asphalt pavements with white cementitious finishes which also reflect away the sun’s heat. The rooftop efficiency measure is so cost-effective it has now been integrated into California’s world-leading Title 24 building standards. Lawrence Berkeley National Laboratory's Heat Island Group, pioneered by University of California at Berkeley Professor Arthur Rosenfeld, Dr. Hashem Akbari and their colleagues, has generated a wealth of knowledge on cooling down heat islands. The following images all come from LBNL's Heat Island Group web site

LIFECYCLE LEAST-COST-AND-RISK (LCR) DELIVERED UTILITY SERVICES

Among a dozen states leading the USA in efficiency gains, California has been the exemplary model. Since the 1980s, California has been a world leader in developing a utility regulatory process that aligns the financial interests of the utility with those of their customers to capture end-use efficiency opportunities. This holds true for private-owned and public-operated utilities. California achieved this alignment by decoupling utility earnings from revenues to eliminate the perverse incentive of expanding supplies that are five times more costly than end-use efficiency gains.

This was combined with a comprehensive Integrated Resource Planning (IRP) methodology that calculated the levelized lifecycle cost-and-risk of delivering utility services from all supply and all end-use efficiency options. All options are priority ranked in order of least-cost-and-risk (LCR). End-use efficiency options have consistently and persistently ranked as the LCR. Ongoing assessments by McKinsey Global indicate LCR end-use options could provide half to three-fourths of all new utility services worldwide, based on utilities’10 to 12 percent fixed earnings on capital.

California’s highly innovative regulatory framework is so effective because it is based on allowing utility companies to recoup lost earnings from reduced sales in return for assisting customers to reduce their utility bills through capture of cost-effective end-use and locally distributed efficiency gains in buildings, factories, appliances and devices. The result is delivery of more services with less energy or water resources.

The powerful paradigm shift refocuses the utility's attention and motivation, because their earnings remain robust even when revenues decline, while customers enjoy lower utility bills through smarter use even though the underlying rate increases (to recoup the utility’s lost earnings). Most importantly, the utility’s capital investment, previously limited to large power plants operating over 30 to 50 year time horizons, is diversified by focusing on a larger pool of lower cost end-use efficiency services.

When combined with California's world leadership in setting continuously stronger appliance and building efficiency standards, these efforts have allowed the state to save customers an average of $165 per capita per year on electric and water utility bills, and the utility sector has CO2 emissions 50 percent below the national average. If all U.S. states had followed California's end-use efficiency model, the U.S. national energy bill would be several hundred billion dollars less per year. The country also would have surpassed the CO2 reduction targets of the Kyoto Protocol at essentially zero cost to ratepayers and taxpayers.

One among many 30% solutions: High-Performance Electric Motor Drive Systems

A clear example of how important comprehensive IRP utility regulatory reform is needed to capture end-use efficiency services involves the persistence and ubiquity of obsolete and inefficient electric motor drive systems around the world. Half of the world’s electricity is consumed by industrial electric drive systems — electric motors, pumps, compressors and fans (60 percent in China).

Fifty percent savings are achievable in new motor systems if high-efficiency electric motor industrial drive system components are implemented by users. However, the conventional practice is to procure technologies that require the lowest capital cost, while ignoring how inefficient they perform in terms of energy consumption, lifecycle costs and emissions. In some instances, these inefficient devices will consume up to 20 times more in electricity costs when compared to the motor’s purchase price.

IRP-based utility efficiency incentive programs have been instrumental for decades in overcoming this distortion; utility financed efficiency upgrades to existing systems can achieve 30 percent savings at five to ten times less cost per kWh when compared to building new generation facilities to power the inefficient devices that dominate the current market.

Worldwide, an initiative for transforming the efficiency of electric motor systems would deliver the services equivalent to 2 trillion kWh per year, equal in services to one-fourth of all power plants planned for construction through 2030. A successful market transformation would reduce global energy bills by ~$1.6 trillion per decade.

The ancillary benefits for a world confronting droughts and water shortages would be significant, as the following illustrates. If motor efficiency gains were used to displace thermal power plants, the savings in water use would range between two and 200 billion m3 per year -- equivalent to the water use of one to 10 Colorado Rivers.

SOURCE: (Left) Amory Lovins, Reinventing Fire, 2012, Rocky Mountain Institute; (right) Chris James, Co-Control of Air Pollutants, Integrated Planning for Environment and Energy BAQ 2012 – Hong Kong, December 2012, Regulatory Assistance Project.

China End-Use Efficiency Example

In China, the potential energy savings from efficiency gains from electric motor drive systems are worth several hundred billion dollars per decade, displacing the need for 63,000 MW of planned power plants. Jiangsu province is leading the effort, identifying 10,000 MW of motor efficiency gains that can be delivered at a cost of US$0.01 per kWh. By comparison, the Jiangsu electricity price delivered to the industrial sector in 2012 was US$0.14 per kWh (0.87 Yuan).

Hypothetically, applied comprehensively to all power-consuming uses throughout China’s residential, commercial, institutional, industrial and agricultural sectors, end-use efficiency and decoupling methodologies could help in avoiding half of an estimated US$10 trillion in utility expenditures incurred from the power plants to be built by 2030.

China has been a world leader in pursuing ambitious energy efficiency targets. From 1980 to 2002, China experienced a 5% average annual reduction in energy consumption per unit of gross domestic product (GDP). There was a dramatic reversal of this historic relationship between 2002 and 2005, when efficiency options were largely ignored and energy intensity increased 5% per year. However, China‘s 11th Five Year Plan (FYP) set a target of reducing energy intensity by 20% by 2010, followed by the 12th FYP target for a 16 percent reduction in energy intensity between 2011 and 2015.

According to a recent assessment by LBNL, selected policies and programs that China has instituted to fulfill the national goal have made substantial progress. Many of the energy-efficiency programs appear to be on track to meet – or in some cases exceed – their energy-saving targets. Most of the Ten Key Projects, the Top-1000 Program (1000 largest companies, consuming about one-third of the China’s energy), and the Small Plant Closure Program (a total of 80,000 MW of inefficient thermal plants and industries were shut down) met or surpassed the 11th FYP savings goals. In the 12th FYP China extended the Top-1000 program to the Top-10,000 program.

Zeroing In on Zero-Emission Supply Options

Wind Power

In less than a decade, China has rapidly become the world’s biggest manufacturer of wind turbines and solar PV panels. The country established a feed-in tariff for wind in 2009 and for solar PV in 2011.

China is developing different FIT rates depending on local resource conditions. The National Development and Reform Commission (NDRC) set four categories of onshore wind projects. Areas with better wind resources get lower feed-in tariffs, while those with lower outputs will be able to access higher tariffs. The wind power tariffs per kWh are set between US$0.082 (0.51 Yuan) and US$0.098 (0.61 Yuan). For comparison, the average rate paid to coal-fired electricity generators is US$0.055 per kWh (0.34 Yuan).

In recent years, China’s ambitious renewable power targets and support for wind energy manufacturers have fueled rapid growth. In 2006, China had only 3,000 MW of installed capacity, and a tiny global player. By late 2012 China surpassed 70,000 MW, reaching nearly one-third of installed global capacity – a 25-fold increase, in six years while the rest of the world only expanded by a factor of 2.6.

China is projected to shatter the government’s 2015 target of 100,000 MW by 50 percent. China has been consistently exceeding its wind growth targets, so it is quite feasible their ambitious targets for 2020 (200,000 MW), 2030 (400,000 MW) and 2050 (1 million MW) will all occur much sooner. China now leads the world both in production and use of wind power.

The USA, with 60,000 MW of installed wind capacity and ranked second with 25% of global total, may not renew the tax incentive for wind power after 2013. A tragic mistake if Congress takes this step. The USA, like China, has immense wind resources, far larger and more economical than even their massive reserves of coal and oil shale.

A 2009 joint assessment by Harvard’s School of Engineering and Applied Science and Tsinghua University’s Department of Environmental Science and Engineering concluded that China’s favorable onshore wind resources could provide nearly 25 trillion kWh of electricity annually, more than five times national consumption in 2012. The team also made a key point, “[A]ssuming a guaranteed price of 0.516 Yuan (7.6 U.S. cents) per kWh for delivery of electricity to the grid over an agreed initial average period of 10 years, wind could accommodate all the demand for electricity projected for 2030, about twice current consumption.”

The Harvard team also analyzed the wind potential worldwide, as well as in the contiguous USA. Writing in the Proceedings of the National Academy of Sciences, they conclude, “that a network of land-based 2.5 MW turbines restricted to non-forested, ice-free, non-urban areas operating at as little as 20% of their rated capacity could supply more than 40 times current worldwide consumption of electricity, [and] more than 5 times total global use of energy in all forms.”

Available wind resources on the U.S. Great Plains were estimated to be as much as 16 times total current U.S. power consumption. The land footprint of wind farms are remarkably small. Analysis indicate the several million wind turbines that could produce as much power as the U.S. currently consumes would take up less than three percent of the Great Plains region. The wind royalties paid to site the wind farms would generate twice as much revenues for the region than farming and ranching currently generate occupying 75 percent of the Great Plains!

Wind power is an established least-cost-and-risk power supply. Both the United States and China could steadily displace all their current and proposed coal power plants, and most natural gas power, with their wind resources. China has current plans to construct 558,000 MW of coal plants (the US 17,000 MW), and the US projects building 141,000 MW of natural gas plants.

When wind (and solar) are phased in with utility bill-reducing efficiency opportunities, the system costs and risks of delivering electricity should be comparable to or less than continuing dependence on coal or natural gas plants powering inefficient devices. This transformational action would also position the two wind-giant nations to seize a substantial share of the multi-trillion dollar wind export market opportunity worldwide.

Solar Power

Beginning in 2011, China established a national feed-in tariff for solar projects, setting the FIT at US$0.15 per kWh. At the end of 2012, China had 5,000 MW of installed solar PV capacity; it also set a new high bar for other nations in committing to solar power. The government declared an eight-fold increase in its solar power target for 2015 to 40,000 MW. This will put China far ahead of any other nation. For comparison, the U.S. had 6,400 MW installed at the end of 2012, with solar tax incentives set to expire in 2015. As in the case of expiring U.S. wind production tax credits, (PTC) this is entirely in the wrong direction to be moving. Why?

First, because it undermines any semblance of a level playing field. Fossil fuels, as well as nuclear power, have received 20 times more government subsidies over the past half century than have solar and wind. Moreover, the tax incentives for solar and wind power represent a minute fraction of the massive costs due to fossil fuel externalities.

Second, unlike fossil fuel power plants (and nuclear and large-hydro), which use 40 percent of U.S. extracted water, solar PV and wind power require 95 percent less water. In a water-constrained world that is only worsening, the water frugality of solar PV and wind power make them low-risk assets over a lifetime of price volatility. They are also inherently low-risk assets in providing protection against any future price volatility as a result of being power generators with zero fuel requirements and zero emissions, pollution and wastes.

Third, given the imperative to expedite a global economy powered with zero emissions, the export market growth potential of solar and wind technology is immense. This is illustrated in the recent global renewable energy scenario by Stanford Professor Mark Jacobson and University of California Professor Mark Delucchi, A Plan for a Sustainable Future by 2030.

Beginning with the implementation of the robust energy efficiency improvements noted above -- a gargantuan export market potential, in itself, in every energy-consuming end-use appliance, device, and equipment category -- the authors show that solar and wind power could provide 90 percent of global total power and energy demand phased in over several decades. Geothermal and hydro power provide most of the other10 percent, while also providing an important storage function to complement the intermittent solar and wind power.

One can debate the achievable annual growth rates, which appear to average 25 percent per year for wind and 40 percent for solar PV. There is historical precedence for such high growth rates. Between 1956 and 1980, before nuclear power fell out of favor, global installed nuclear generating capacity grew at an average rate of 40% per year. Like nuclear power in its heyday, wind and solar will need strong, sustained supporting public policies to maintain such high growth rates.

Powering Mobility

A key component of the Jacobson-Delucchi assessment is the shift to ultra-lightweight battery-electric vehicles (BEV) for displacing petroleum-fueled combustion engines, and entirely avoiding biomass-fueled vehicles. Converting crops to fuels is very inefficient, while requiring enormous land area and water consumption. For example, just shifting from diesel to biodiesel to fuel the world’s maritime fleet would require a 40-fold expansion of current global production of oil palm plantations. Oil palm plantations have been one of the primary causes of widespread deforestation (and CO2 emissions) of biodiversity-rich rainforest in recent decades.

As car manufacturers replace heavy steel components with crash-impact resistant ultra-light carbon composites, a vehicle’s reduced mass significantly reduces the amount of batteries required. Most of the running cost of a BEV is for the maintenance of the battery pack, and its eventual replacement. A BEV incurs low maintenance costs because it has only around five moving parts in its motor, compared to hundreds of parts in a gas-fueled internal combustion engine.

Electric drive systems are four to five times more efficient (80%) than diesel (20%) or gasoline engines (15%), respectively. According to the U.S. Environmental Protection Agency (EPA) fuel economy ratings for city driving, the 11 BEV models sold in 2012 averaged between 33 and 59 kilometers per liter-equivalent, km/l-e (77 to 138 mpg-e). By comparison, the EPA fuel economy rating for the average new (fuel combustion) car in 2012 was 9.4 km/l (22 mpg).

EPA estimated the total CO2 emissions from a new gasoline car at 311 grams per kilometer (500 g/mile), which includes upstream gas production and tailpipe emissions. The grams of CO2 per km for a BEV varies greatly, since it depends on how clean or dirty is the power grid. The Jacobson-Delucchi clean grid scenario would result in BEV CO2 emissions near 10 g/km, whereas an all-coal grid would exceed 250 g/km.

Both China and the USA officials have raised security concerns that more than 50% of their oil use is dependent on vulnerable foreign oil imports, and China’s oil imports are projected to double by 2020. This is the major impetus for both nations in promoting domestic oil shale reserves and biofuels, despite substantially increasing CO2 emissions.

China is the world’s largest car producer, manufacturing 1 of every 4 cars, and the car markets in China and the US jointly account for more than one-third of world sales. McKinsey Consulting noted in their recent report, Recharging China’s electric vehicle aspirations, that if China were to achieve US levels of per-capita vehicle penetration, its demand for oil would increase 15-fold, exceeding total global production. BEVs are critical to China’s economic, security, and environmental sustainable growth.

In his 2011 State of the Union speech, President Obama, announced a goal of having 1 million BEVs on the road by 2015. This coincided with China’s 12th FYP targets for ownership of 5 million BEVs and PHEVs (plug-in hybrid electric vehicles) by 2020. Both governments have made multi-billion dollar commitments in developing advanced batteries, and providing consumers with incentives to purchase EVs. However, as the McKinsey EV report details, both nations are in need of substantially refined policies and incentives to ensure a steady acceleration and scaling of BEV production and sales.

BEV bicycles and scooters are an entirely different, and highly successful story. China has experienced an explosive growth of sales of BEV bicycles, scooters and motorcycles, with annual sales jumping from 56,000 units in 1998 to over 21 million in 2008. China is home to 150 million e-bikes as of 2012, with sales increasing 10% per annum. China is the global leader both in the production (22 million per year) and consumer use of e-bikes. Sales of more than 466 million e-bikes and scooters are projected by 2016, with China continuing to dominate the world market with more than 95% of sales.

Furthermore, with gas prices exceeding US$0.80 per liter ($3 per gallon) -- equivalent to electricity at $0.32 per kWh -- solar electric charging stations are cost-effective to power the world’s e-bikes.

The combination of solar and wind powering ultra-lightweight BEVs accrue multiple economic and environmental benefits: dramatic gains in urban and rural air quality and tremendous health gains for the severely afflicted citizens experiencing record-breaking air contamination, elimination of vulnerable and volatile-priced foreign oil imports, financial savings from avoided gasoline purchases, elimination of vehicle emissions, and deep reductions in CO2 emissions.

FEED-IN TARIFFS - FIT POLICY FOR DRIVING ZERO EMISSION OPTIONS

Feed-In Tariffs (FIT) are proving essential for spurring zero and near-zero emission power options -- solar, wind, geothermal, biowastes, small-scale hydro. Depending on how effective a FIT is designed and implemented can lead to order of magnitude differences in the amount of clean power harnessed. Given the urgency this decade in reducing CO2 emissions, adoption of highly effective FITs become an imperative for aligning good governance and flourishing markets. As of 2011, feed-in tariff policies have been enacted in China, 7 U.S. states, and in more than 50 countries.

Utility investments in regulated states typically receive a guaranteed 10 to12 percent return on investment. FITs are often set to provide an 8 to 10 percent internal rate of return (IRR). A FIT guarantees a long-term purchase contract for electricity to help investors recover their investment. Solar, wind, and end-use efficiency projects have no fuel, water or waste storage and disposal costs, so their entire investment is up front. Long term contracts, generally 20 years, ensure that energy providers recover their costs and help them secure financing.

The benefits of a well-designed and implemented FIT outweigh the costs of the premium paid to renewables even without taking into account the economic development impacts. The German ministry overseeing their feed-in tariff estimates that the total benefits of the legislation have exceeded the costs by a factor of three.

Check back for further developments. michael p totten, founder & principal, AssetsforLife.net. LinkedIn background info.